-

Paul Chappell

Paul Chappell

For businesses in the hospitality sector operating a tronc scheme, understanding the consultation requirements is not just a matter of good practice; it’s a legal obligation that keeps your scheme HMRC-compliant and tax-efficient. And the Employment Rights Act 2025 is...

-

Alison Clynes

Alison Clynes

If you’re running a hospitality business with a tronc scheme, you’ve probably spent the last year getting to grips with the Employment (Allocation of Tips) Act 2023. Fair distribution, transparent policies, detailed record-keeping – it’s been a lot. But compliance...

-

Paul Chappell

Paul Chappell

Managing tips fairly whilst staying compliant isn’t just about ticking boxes anymore. From 1 October 2024, when the Employment (Allocation of Tips) Act 2023 became fully enforceable, fairness and transparency became legal requirements, not nice-to-haves. And with the Employment Rights...

-

Paul Chappell

Paul Chappell

If you’re running a hospitality business, you’ve probably heard about the Employment Rights Bill. The Bill received Royal Assent on 18 December 2025, officially becoming the Employment Rights Act 2025, and it’s bringing some of the biggest changes to employment...

-

Paul Chappell

Paul Chappell

If you work in hospitality, where customers leave tips, you’ve probably heard about the Employment (Allocation of Tips) Act 2023. It came into force on 1 October 2024, and it’s changed the game for how tips are handled in the...

-

Paul Chappell

Paul Chappell

If you’re running a hospitality business with a tronc scheme, you’ve probably wondered whether those tip payments need to be included in your auto-enrolment pension calculations. It’s a fair question, especially when you’re trying to get your payroll right and...

-

Alison Clynes

Alison Clynes

With the increasing amount of tips given by customers on their card or via contactless payment methods, rather than cash, it highlights a practice that some operators allow, which could land them in hot water. Cashing out. Cashing out occurs...

-

Alison Clynes

Alison Clynes

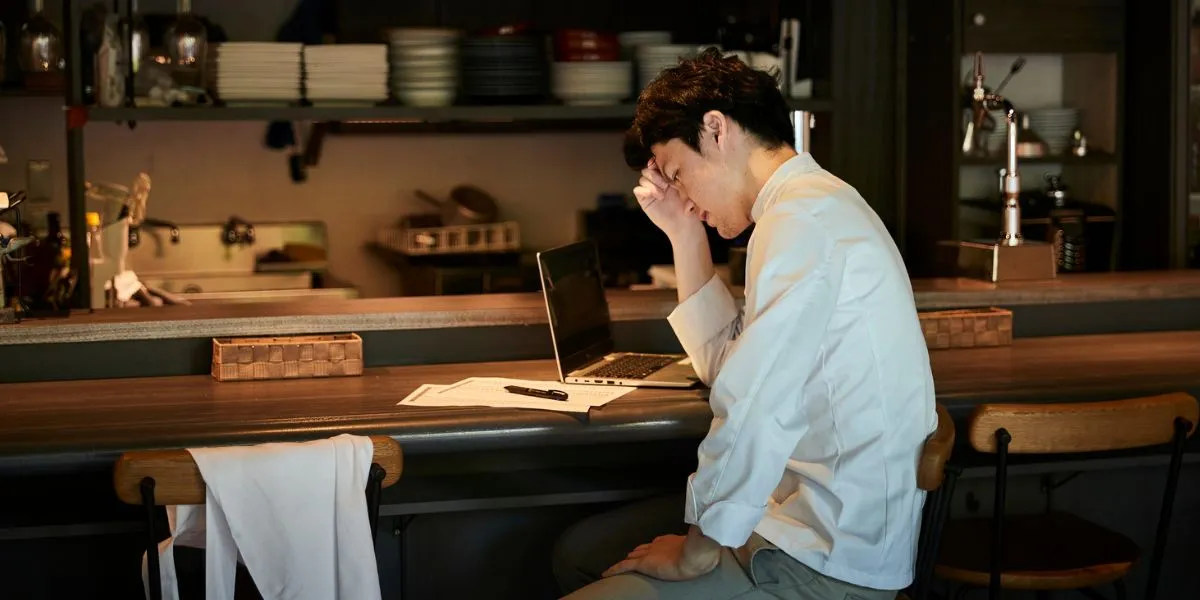

HMRC penalties and tribunal fines for non-compliant tipping You are confident your tips policy is compliant and have set up what you think is a proper tronc scheme. Your tips are being distributed. Staff seem happy. Everything looks fine. Then...

-

Alison Clynes

Alison Clynes

Running a tronc scheme isn’t complicated, but get it wrong and you could face some serious consequences. We’re talking thousands in unexpected tax bills, unhappy staff, and potential tribunal claims under the new tipping legislation. Over the years, we’ve seen...

-

Paul Chappell

Paul Chappell

If you run a restaurant, hotel, bar, or any hospitality business where tipping is common, you’ve likely grappled with the question of how to fairly and efficiently distribute tips among your staff. For many, a tronc scheme is the answer....